Clouds of Vagueness

Archive for 2012

Risk registers, bloody risk registers

It all sounds so simple. Just make a list of all the risks. Then you can start figuring out how to prioritise them and manage them in a comprehensive and visible way. Job done. This was how it seemed back in the early 90s when we took some tools that had proven quite effective for the management of […]

5%

One of my previous Wanderings mused on the power of soundbites, and specifically the encomium, “nothing between men is 3 to 1.” Turned into more mathematical language we get the Harry the Horse Theorem: in a two point sample space where the outcome is affected by the action of humans, managers, or anyone else who thinks […]

What’s the use of risk?

This week the the IRM held its Annual Lecture at the Willis Building. This is a longstanding sponsored breakfast event which used to be held at the old Willis building at Ten Trinity Square. It’s usually a thought-provoking occasion though since Willis’s move to Lime Street health and safety considerations have somehow stopped them dishing up bacon and sausage sandwiches. Such […]

Three to one

The power of a nice soundbite … The title of this site is based on a quotation that I, personally, find a very evocative expression of the risk in business problem. I was reminded of another elegant problem framer whilst getting stuck into Antifragile, Nassim Nicholas Taleb’s final volume of his trilogy on risk. This, like […]

The profession that knows it all

The theme which underpins Clouds of Vagueness is the inherent difficulty of mastering an uncertain future and the inadequacy of our standard risk management techniques to help with this. So I was delighted to see the paper by Michael Power of the LSE in the journal Accounting, Organisations and Society, with the provocative title The risk management of […]

Risk appetite – a bad idea

It’s a truism that you can’t do anything – or even nothing – without taking risk. This is an important issue for all organisations, but the discussion of what risk to take has become unnecessarily obscured. Specifically it has become bogged down in the unhelpful concept of ‘risk appetite’ and this has added to the […]

COSO on risk appetite – reaching for the ideal

COSO have also issued guidance on the ‘risk appetite’ to go along with that of the IRM and other authorities. I think it’s a good example of how risk appetite would be dealt with in an ideal world. By this I mean a world with two characteristics: you could decide how much risk you wanted to dial […]

Nate Silver – risk geek superhero

Before the moment has passed I thought it would be a good idea to celebrate a hero who sputtered across the UK firmament just after the US presidential election. Apart from its intrinsic interest, this post will serve as a placeholder until I get round to having a closer look at what happened and see what […]

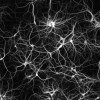

Complexity, cockroaches and building resilience

The near collapse of the financial system was fairly widely predicted though the political community is somewhat in denial about that. What was less widely foreseen was that it would happen in September 2008: it was a risk waiting to materialise as we risk geeks say. Two authors with a gold-plated prediction record on this, […]

The end of cycles

Here’s something that I’ve taken from a blog I did on how decisions are taken in public life and the role of media in supporting them (or not). Economists have laboured for years to model the behaviour of markets. The models have become ever more complex and contain ever more parameters to help fitting the results to […]